In an age of instant digital payments, credit card points, and buy-now-pay-later offers, our relationship with money has become increasingly abstract. We tap a card or a phone, and a transaction happens somewhere in the digital ether. This convenience comes at a cost: a disconnect from our own spending habits. If you’ve ever found yourself staring at a bank statement, genuinely surprised by where your hard-earned money went, you’re experiencing a very modern problem.

The solution, ironically, might be a decidedly old-school method that has stood the test of time. The cash envelope system is a tangible, hands-on approach to budgeting that forces a pause, encourages mindfulness, and puts you back in the driver’s seat of your financial life. It’s not about complex software; it’s about clarity, intention, and the simple power of physical cash.

Why Go Analog in a Digital Age? The Power of “Spending Friction”

The primary reason the cash envelope system is so effective is because it re-introduces something called “spending friction.” When you swipe a card, there’s almost no friction—it’s a smooth, thoughtless process. But when you have to physically count out bills and hand them over, your brain registers the transaction differently. You feel the money leaving your possession. This small moment of friction makes you more conscious of your purchases and helps curb impulsive spending.

What Exactly is the Cash Envelope System?

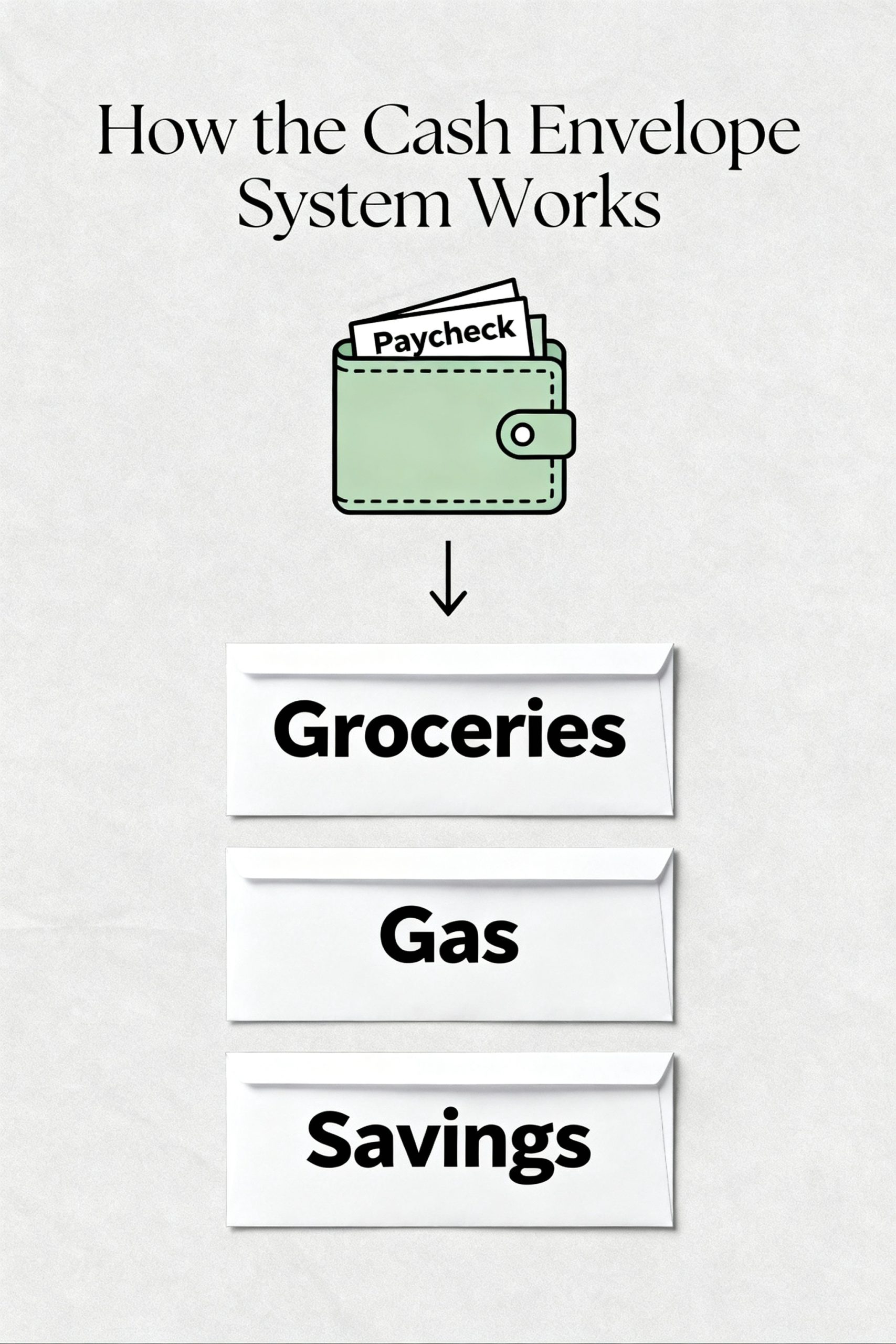

At its core, the system is beautifully simple. You divide your variable income—the money left over after fixed bills like rent and utilities are paid—into specific spending categories. Each category gets its own labeled envelope, which you then “stuff” with the cash amount you’ve budgeted for that category for the month (or pay period).

Common categories include:

- Groceries

- Gas & Transportation

- Restaurants / Take-Out

- Personal Care (haircuts, toiletries)

- Household Goods

- Entertainment & Hobbies

- Clothing

The golden rule is absolute: When the cash in an envelope is gone, you stop spending in that category until the next budget cycle. No borrowing from other envelopes, and no swiping the debit card “just this once.”

Your Step-by-Step Guide to Starting Today

Transitioning to this method is straightforward. Here’s how to set it up for success.

Step 1: The Foundation – A Realistic Budget

You can’t allocate money you don’t have. The first step is to get a clear picture of your finances.

- Track Your Income: Know exactly how much money is coming in each month after taxes.

- Identify Fixed Expenses: List all your non-negotiable bills that are roughly the same each month (rent, insurance, car payments, phone bill, subscriptions).

- Analyze Variable Expenses: This is the crucial part. Go through the last 1-2 months of your bank and credit card statements. How much did you actually spend on groceries, gas, dining out, etc.? Be honest with yourself. This isn’t about judgment; it’s about data.

- Set Your Budget Amounts: Based on your analysis, assign a realistic dollar amount to each of your chosen cash envelope categories.

Step 2: Prepare Your Materials

Gather your tools. You can use simple, plain white envelopes. Some people prefer to purchase durable, reusable envelope systems or even stylish zippered pouches. The tool doesn’t matter as much as the consistency. Label each envelope clearly with its category.

Step 3: The “Cash Stuffing” Ritual

On payday, after your fixed bills have been accounted for, go to your bank and withdraw the total amount of cash needed for all your envelopes. Sit down at home and methodically “stuff” each envelope with its designated amount. Many people find this bi-weekly or monthly ritual to be a calming and empowering moment of financial check-in.

Step 4: Spend with Intention

This is where the system comes to life.

- Going to the supermarket? Grab only your “Groceries” envelope.

- Meeting a friend for coffee? Take your “Restaurants” or “Fun Money” envelope.

- Leave all other envelopes and your debit/credit cards at home. This removes temptation and forces you to stick to your plan.

Pro-Tip: Managing Leftovers and Change

What should you do with money left in an envelope at the end of the month? It’s a great problem to have! You can “roll it over” to the next month for a little extra padding in that category, or you can use it to make extra progress on a financial goal, like paying down debt or adding to your savings. For loose change, keep a jar at home and empty your pockets into it daily. You’ll be amazed at how quickly it adds up.

Overcoming Common Hurdles: Your Questions Answered

“Is it safe to carry that much cash?” You never carry all your cash at once. You only take the specific envelope you need for that particular errand. The rest of your envelopes should be stored in a secure place at home.

“What about online shopping or gas pumps that require a card?” The cash envelope system is designed for the categories where you have the most spending leakage. For things like online shopping or paying at the pump, you can adapt. One popular method is to use a separate checking account or a reloadable prepaid debit card. You can transfer your budgeted amount for “Online Shopping” or “Gas” to that card, treating it like a digital envelope.

“What happens if I run out of money in an envelope mid-month?” This is the system working! It’s showing you where your budget might be unrealistic. The first month or two is a learning curve. If your grocery envelope is empty on the 20th, it’s time to get resourceful with what’s in your pantry. It’s a tough-love lesson that will help you adjust your budget for the next month to be more accurate. Avoid the temptation to “borrow” from another envelope, as this defeats the purpose.

The cash envelope system is more than just a budgeting trick; it’s a tool for rebuilding your relationship with money. It fosters discipline, encourages intentionality, and provides the profound satisfaction of knowing exactly where every single one of your dollars is going.